how much state tax is deducted from the paycheck

How Is Tax Deducted From Salary. Personal income tax 175 on taxable income between 20001 and 35000.

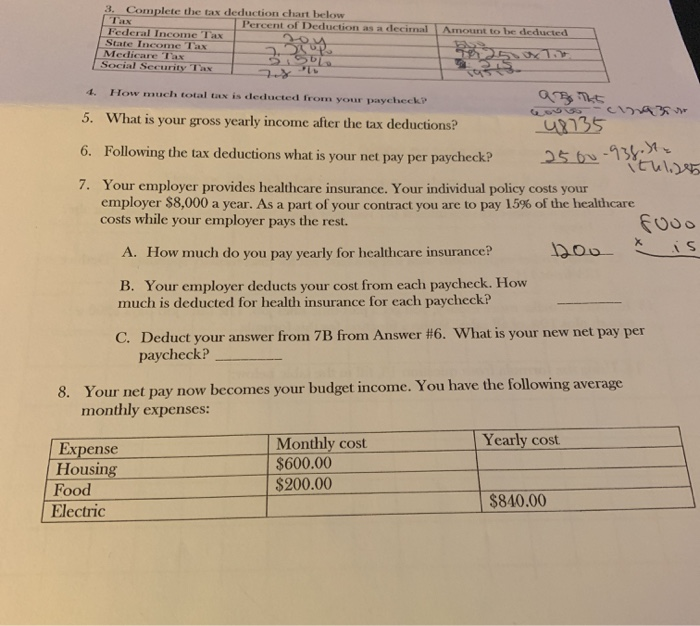

3 Complete The Tax Deduction Chart Below Percent Of Chegg Com

That is to say when workers have earned such an.

. Do you pay taxes on your paycheck in Georgia. The mentioned tax has a limit of 147000 earned in the year. Many states offer a.

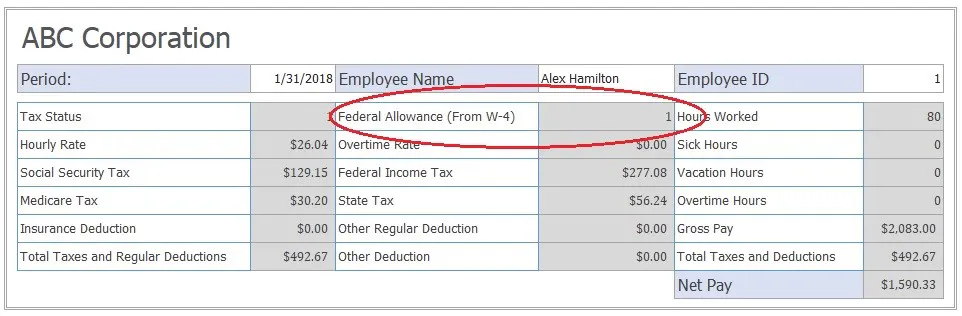

Federal income tax and FICA tax. At one time you could deduct as much as you paid in taxes but TCJA limits the SALT deduction to 10000 or. The result is that the FICA taxes you pay are still only 62 for Social Security and 145 for Medicare.

FICA and State Insurance Taxes. If you make 10000 a year living in the region of California USA you will be taxed 885. The refunds are not taxable as income at the state level.

In October 2020 the IRS released the tax brackets for 2021. Divide the sum of all assessed taxes by the employees gross pay to determine the percentage of taxes deducted from a paycheck. With it the worker is deducted 62 of their gross paycheck.

For your 2021 taxes which youll file in 2022 you can only itemize when your individual deductions are worth more than the 2021 standard deduction of 12550 for single filers 25100 for joint filers and 18800 for heads of household. State sales tax rates in Florida are 600 percent local tax rates are 200 percent and the combined average of state and local sales taxes is 701 percent. Use this tool to.

The Social Security tax is 62 percent of your total pay until you reach an annual income threshold. Yes Georgia residents do pay personal income tax. Specifically the state and local tax deduction allows you to deduct up to 10000 of your state and local property taxes as well as your state income or sales taxes.

North Carolinas flat tax rate for 2018 is 549 percent and standard deductions were 8750 if you filed as single and 17500 if you were married and filing jointly. How Your Paycheck Works. The deduction for state and local taxes is no longer unlimited.

Jan 12 2021 the tax rate is 6 of the first. The percentage rate for the Medicare tax is 145 percent although Congress can change it. The SALT deduction is only available if you itemize your deductions using Schedule A.

That means that your net pay will be 9115 per year or. The payer has to deduct an amount of tax based on the rules prescribed by the. Income Tax Calculator California.

Paycheck Tax Calculator. Social Security tax and Medicare tax are two federal taxes deducted from your paycheck. The state and local tax deduction allows you to deduct up to 10000 of your state and local property taxes as well as your state income or sales taxes.

35 on taxable income between 35001 and 40000. Your employer pays an additional 145 the employer part of the Medicare tax. There are no income limits for Medicare tax so all covered wages are subject to Medicare tax.

See how your refund take-home pay or tax due are affected by withholding amount. All tax refunds including the 62F refunds are taxable at the federal level only to the extent that an individual claimed. What is the NJ income tax rate for 2021.

Estimate your federal income tax withholding. Medicare tax is levied on all of your.

Indiana Moneywise Matters Indiana Moneywise Matters New Year New You Anatomy Of Your Paycheck Part 2

2022 Federal State Payroll Tax Rates For Employers

Salary Paycheck Calculator How Do You Calculate Your Take Home Pay Marca

How Much Does An Employer Pay In Payroll Taxes Payroll Tax Rate

How To Calculate California Income Tax Withholdings

Payroll Tax Rates 2022 Guide Forbes Advisor

Tax Reform And Your Paystub Things To Know Credit Karma

:max_bytes(150000):strip_icc()/Paycheck_AdobeStock_154492502_Editorial_Use_Only-b62ac70013ec4e13b3e2a73be5e9c239.jpeg)

How To Make Sense Of Your Pay Stub

Us States Where The Most Taxes Are Taken Out Of Every Paycheck

Esmart Paycheck Calculator Free Payroll Tax Calculator 2022

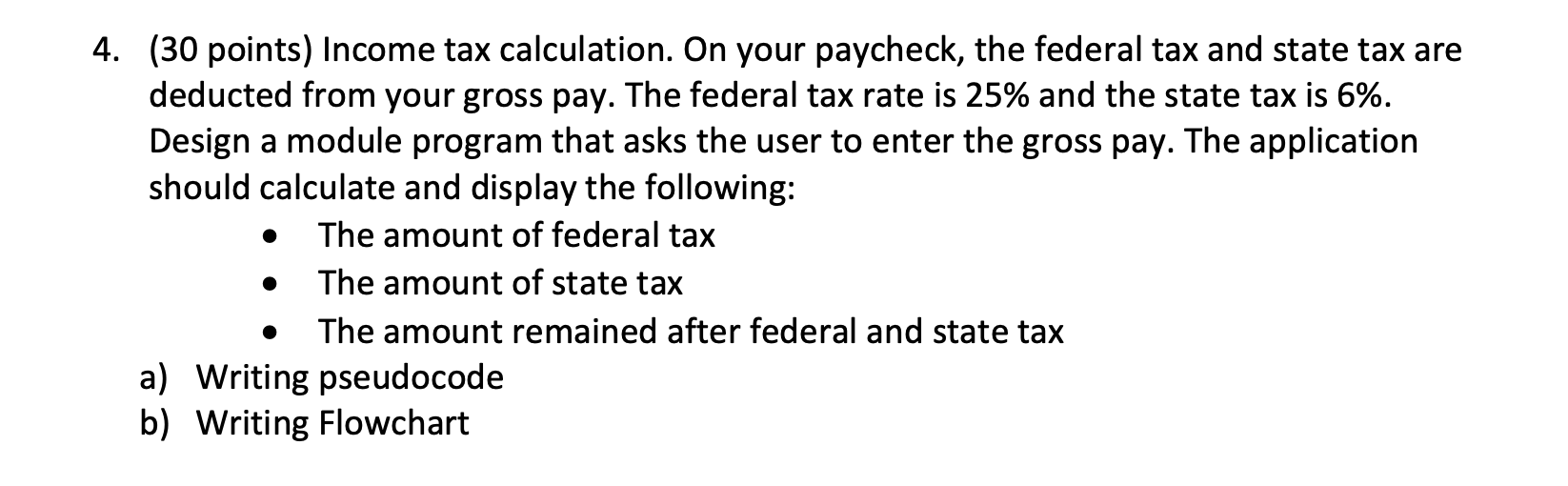

Solved 4 30 Points Income Tax Calculation On Your Chegg Com

How To Fill Out Form W 4 In 2022 Adjusting Your Paycheck Tax Withholding

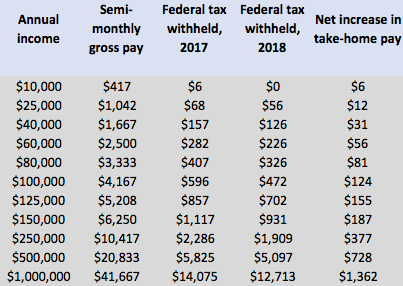

Irs New Tax Withholding Tables

Taxes For Teens A Beginner S Guide Taxslayer

How To Read Your Paycheck Stub Clearpoint

:max_bytes(150000):strip_icc()/what-is-included-on-a-pay-stub-2062766-FINAL-edit-f9458e043f2e4c5ab87a4ef5cec0cd5d.jpg)

:max_bytes(150000):strip_icc()/payroll-taxes-3193126-FINAL-edit-dd1093830a124f23924fcf6d0bb18a03.jpg)